SP & PT versions under construction

Ammonia

Green H2 derivative: NH3

H2 has the highest energy content of all chemical fuels when measured by mass at 120.2 MJ/kg, compared to heavy fuel oil at 40.2, ammonia at 22.5 (about 6x less than H2), and methanol at 19.9 [PS, 2022]. The drawback - and it's a big one - is that H2 has a very low energy density per volume.

Current H2 use is centered around oil refining (hydrodesulfurization & hydrocracking, the latest one started in the 1930s) and ammonia & methanol production, which are the main candidates to deliver zero-emission shipping. Also, ammonia & methanol could be attractive options as hydrogen carriers at a large scale because of their compatibility with existing liquid fuel infrastructure.

Ammonia - NH3

Ammonia (NH3) is a bulk chemical normally synthesized from natural gas (NG) and mainly used as chemical feed-stock, e.g. in fertilizer production [RB, 2021]. It is the most popular substance as a green hydrogen (GH2) carrier because it does not carry carbon atoms.

Ammonia gas can be stored as a liquid at room temperature under a pressure of just 10 bar (147 psi), or under atmosphere pressure at -33 °C [EN, 2022]. Liquid ammonia is non-corrosive, so internal pipeline corrosion is extremely unlikely. Current ammonia production is mostly used for agricultural purposes. The total H2 content of ammonia is higher than other fuels (5,7 kg of NH3 carries 1 kg of H2), and is thus suitable to (re)convert to hydrogen.

Main producers & market size

Ammonia production has remained fairly stable in recent years. In 2022, the global production of ammonia was estimated at some 150 million tons [STAT, 2023]. China is the world's leading producer of ammonia. w/ an estimated production at around 42 million tons of contained nitrogen in 2022. China was followed by Russia, the U.S., and India, each with more than 10 million tons produced [STAT, 2023].

Ammonia market size was valued at USD 68.69 Bn in 2021 and is projected to reach USD 123.12 Bn by 2030, growing at a CAGR of 6.82% from 2023 to 2030 [VMR, 2023]. Ammonia will likely have a lower initial uptake than e-methanol until 2040, but then scale faster from 1,100 PJ (8% of the shipping fuel mix) in 2040 to 4,500 PJ (35%) in 2050 [DNV, 2022].

Advantages & disadvantages

Advantages of ammonia as a fuel include a relatively high power-to-fuel-to-power (PFP) efficiency, a high technological maturity, a large-scale distribution infra that is already in place, a high-octane rating of 110–130, and a narrow flammability range, making it relatively safe in terms of explosion risks [SD, 2022].

But, due to the safety concerns (toxicity), it is questionable whether authorities would permit the transportation and use of ammonia in populated areas. Although no ammonia-powered demonstration vessel has yet sailed, several shipping-related consortia have initiated projects that should lead to ammonia-powered vessel demonstrations by 2023/2024.

Synthesis - Haber-Bosch

Synthesis of ammonia has been carried out by Haber-Bosch (HB) process since the beginning of the 20th century, which converts atmospheric nitrogen (N2) to ammonia (NH3) by a reaction with H2 using a metal catalyst (typically an iron oxide - Fe3O4) under high temperatures & pressures (Figure 1). The HB process, where nitrogen and hydrogen molecules react to form ammonia (N2 + H2 → NH3), accounts for 1.4% of global CO2 emissions and consumes 1% of the world's total energy production [NE, 2019].

Applications

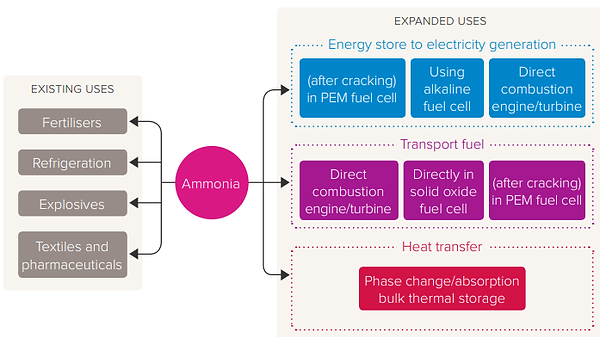

Traditionally used in the production of nitrogen fertilizers or as industrial refrigerant, ammonia now finds new uses riding the energy transition wave. Figure 2 shows some new ammonia applications.

Figure 3 shows urea synthesis process (CO2 + 2NH3 → NH2COONH4 & NH2COONH4 → CH4N2O + H2O), from ammonia & CO2. Urea, which has fusion point of 132.7 °C, is used in fertilizers as a (relative cheap) source of nitrogen to promote plant growth. Figure 4 shows the temperature thresholds of the urea synthesis.

International Maritime Organization (IMO), the UN agency responsible for the safety & security of shipping, has established new regulations to reducing emissions by at least 40% by 2030 (and pursuing 70% by 2050 compared to 2008 levels), choosing ammonia as alternative fuel (among others, such as ethane & dimethyl ether). Figure 5 shows the world maritime sector energy demand by carrier, highlighting the use of ammonia in the coming years.

The IEA’s Sustainable Development Scenario (SDS) envisions that ammonia demand in 2050 will total 230 Mt for fertilizer & 125 Mt for novel uses, primarily in marine fuel and power generation [ICEF, 2022].

Figure 1: Haber-Bosch synthesis process

Figure 2: Ammonia existing & expanded uses

Figure 3: Urea synthesis process

Figure 4: Urea synthesis: temperature thresholds

Figure 5: World maritime subsector energy demand by carrier